The Following Are Advantages of the Sml Approach:

What are implications of pecking-order theory. A The model explicitly incorporates the relevant risk of the stock.

Question 2 When estimating the cost of equity which of the following are advantages of the SML approach.

. Waddell Company had the following balances in its accounting records as of December 31 2018. Answer of SML Cost of Equity Estimation What are the advantages of using the SML approach to finding the cost of equity capital. Yields can be calculated from observable data.

What is the Security Market Line SML. It graphs the relationship between beta β and expected return ie. RE Rf Beta x RM- Rf The following are disadvantages of the SML approach - requires estimation of the market risk premium.

Requires estimation of the market risk premium. The Security Market Line SML is the graphical representation of the capital asset pricing model CAPM with the x-axis representing the risk beta and the y-axis representing the expected return. The advantages of using the SML approach are.

Which of the following is true about a firms cost of debt. B The method is more widely applicable than is the DGM model since the SML doesnt make any assumptions about the firms dividends. Key Features of a true SML programme In distinguishing SML from other learning methods the power of the approach lies in the combination of the following elements.

SML or CAPM Advantages and Disadvantages of Dividend Growth Model Advantage. Easy to understand and use Disadvantage. The following are advantages of the SML approach.

The SML approach is applicable to almost all companies. The SML Approach Use the following information to compute the cost of equity. 28 Days sales.

CAPM formula shows the return of a security is equal to the risk-free return plus a. How to estimate these parameters. Project B would be accepted if WACC was used as the discount rate because its IRR is greater than the WACC.

The SML approach explicitly adjusts for the riskiness of the investment. ADVANTAGES AND DISADVANTAGES OF SML. The following are advantages of the SML approach multiple answers a.

Advantages of using the SML approach to find the cost of capital. The SML model along with the CAPM is very easy to use and easily comprehendible. C Dividend growth is known whereas estimating beta for the SML is an art form.

125 Total assets turnover. 1 Acquired 20000 cash from the issue of common stockFeb. Adjusts for risk c.

The SML like any other indicator has certain advantages and certain disadvantages as well. The following accounting events apply to Waddell Companys 2018 fiscal yearJan. The curriculum is not separate from the learner who is responsible for its design according to perceived needs Adequate time must be given to the crucial diagnostic phase.

Let us understand first the advantages it offers. Advantages and Disadvantages of the Security Market Line. Requires estimation of beta d.

The security market line SML is a visual representation of the capital asset pricing model CAPM Capital Asset Pricing Model CAPM The Capital Asset Pricing Model CAPM is a model that describes the relationship between expected return and risk of a security. A It is easy to fit flotation costs into the dividend growth model but not the SML. The following are advantages of the SML approach adjusts for risk and does not require the company to pay a dividend Dividends paid to common stockholders ____ be deducted from the payers taxable income for tax purposes.

What are the advantages of using the SML approach to finding the cost of equity capital. B The dividend growth model uses market information but the SML does not. What are the advantages of using the SML approach to finding the cost of equity capital.

The project offers a return greater than that needed to compensate for its level of systematic risk and accepting it will increase the wealth of shareholders. Complete the balance sheet and sales information in the table that follows for Hoffmeister Industries using the following financial data. The formula of the SML is.

What are the specific pieces of information needed to use this method. ABC company had had the following operating results for 2015. It is easier to estimate than the cost of equity.

O Risk-free rate R f o Market risk premium ER M - R f o Systematic risk of asset B o R E R f B E ER M R f F. Advantages and Disadvantages of SML Advantages o Explicitly adjusts for systematic risk o Applicable to all companies as long as we can estimate beta Disadvantages o Have to. What parameters are needed to use this method.

O Only applicable to companies currently paying dividends o Not applicable if dividends arent growing at a reasonably constant rate o Extremely sensitive to the estimated growth rate an increase to G of 1 increases the cost of equity by 1 o Does not. Name Change Consultants on Accounting Which of the following are a managerâs three primary responsibilities. 1 Paid 6000 cash in advance for a one-year lease for office.

C Rf 0 SML WACC β Company β A x B Required rate of return x D. It is easy to estimate the inputs beta and market risk premium to the SML approach. It shows expected return as a function of β.

Does not require the company to pay a dividend b. What are the disadvantages. The market risk premium is expected to be 9 and the current risk-free rate is 6.

Adjusts for risk does not require the company to pay a dividend. The following are advantages of the SML approach - adjusts for risk - does not require the company to pay a dividend. We have used analysts estimates to determine that the market believes our dividends will grow at 6 per year and our last dividend was 2 D 0.

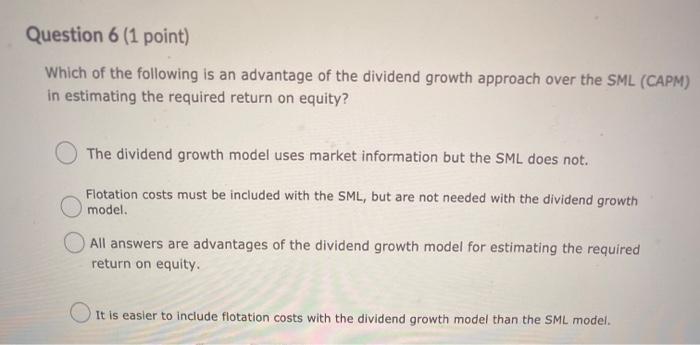

14-15 Suppose our company has a beta of 15. D All are advantages of the dividend growth model for estimating the required return on equity.

Solved Question 6 1 Point Which Of The Following Is An Chegg Com

Comments

Post a Comment